Introduction

Revolution Populi (RVP) is a blockchain designed to perform three functions;

- A layer-1 database that allows users to opt into the Decentralized Autonomous Organization (DAO) that makes their personal data accessible to the public. The DAO is apart from any central authority.

- An open-source blockchain to bundle social net components that all interface with the layer-1 database. This would allow anyone to build a social media network for others to join that is a part of the DAO. This is the primary endgame of RVP, the function that would allow options other than Facebook or Twitter to exist.

- A cryptocurrency clearinghouse app built on top of the Layer-1 protocol as a product offering for Business to Business (B2B) transactions. A clearinghouse is a financial institution to facilitate payments, securities, or derivatives transactions. This function would serve to keep the entire RVP ecosystem funded and truly sovereign.

Data

All Data Is At Time Of Writing

Max Supply: 2,000,000,000

Total Supply: 2,000,000,000

Circulating Supply: 1,200,000,000 (60%)

Ethereum Contract Address:

0x17ef75aa22dd5f6c2763b8304ab24f40ee54d48a

What’s the distribution breakdown of the total 2,000,000,000 generated tokens?

- 1,200,000,000 (60%) Public Sale

- 200,000,000 (10%) held in escrow for blockchain operations*

- 200,000,000 (10%) held in escrow for grants*

- 200,000,000 (10%) marketing, admin – discretionary

- 200,000,000 (10%) to the RevPop team (locked up for additional 18 months after Main Net launch & Token Swap)

*Tokens to be held in escrow for a DAO foundation, with 20,000,000 tokens (1% of total) distributed per year for 10 years.

Website

Telegram

Join the Telegram here and communicate with the community

White Paper

CoinMarketCap

Layer-1 Test Net

Token Use

(How Does RVP Fit Into the Grand Design...AND WHY YOU SHOULD INVEST)

The RVP token inside of the Layer-1 ecosystem allows users to use a variety of apps that can provide consumer services. The main interaction of the RVP token will be from the social platform component, as the whitepaper states;

In social networks, the business model is about advertising dollars, which all goes to them. In this new ecosystem, since the user owns and controls their data, different apps with different feature sets (some more appealing than others) can compete based on the quality of their services, which has always been the case; but now they will need to compete on price too.

Advertising revenue is generally paid to the platform, and the user doesn't get a share of the profits, even though their data is being utilized. RVP would be flipping this dynamic to what a content advertiser would be willing to pay the users of the platform.

Any app brought to this ecosystem would be able to integrate RVP into their payment system for users to pay for, from the data users are already being paid from. It would be an elaborate system that nets the payment of the user for data, which allows the user to recirculate their payment for services.

Holders of RVP will also see price appreciation from the uses of the clearinghouse function.

Within financial services, interestingly enough, this layer-1 database is also uniquely designed to manage trade settlements, trade matching, and hosts of back-office functions, especially in the cryptocurrency sphere. As services such as exchanges or clearinghouses wish to use the layer-1 database, they too could be paid for their services in RVP in a seamless and atomically settled way; and products like the aforementioned DeFi guarantee fund could also use the RVP token.

The Blockchain

Layer-1 Prototype

Repositories:

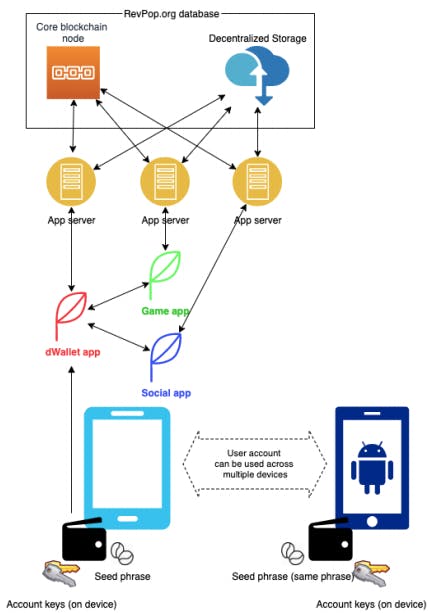

Think of Layer-1 as a data facility that stores user data, and enables the user to connect to apps through a filtered wall. The accounts are created and stored on the wallet the user has on their device, controllable with a key, or seed phrase, the user would create upon account activation. This key acts similarly to Metamask when asked to sign transactions or connect to content.

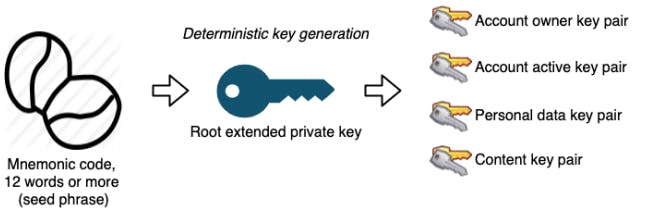

Key Generation

Ecosystem

Applications would be installed on a user’s device. The dWallet app creates a blockchain wallet for the user. All app data, except the wallet keys, can then be synchronized between devices using cloud. Applications can communicate with the blockchain directly or through an app server. They can read data from the blockchain as well as from the cloud storage (or decentralized storage, as the case may be). Restricted information can only be unlocked from the user’s device, or the application server (but only if explicit permission is granted).

The Team

Dr. David Gelernter/Chief Visionary Officer

Dr. Gelernter is a Professor of Computer Science at Yale University and primarily has involvement in the realm of Parallel Computing.

Dr. Gelernter is a Professor of Computer Science at Yale University and primarily has involvement in the realm of Parallel Computing.

Rob Rosenthal/Chief Executive Officer

Rosenthal is a 19-year veteran of Goldman Sachs. He was one of the key negotiators assigned to the industry group that implemented global CDS clearing following the financial crisis of 2008

Gary Chan/Managing Director of JP Morgan- Clearing House Advisor

Chan has over 20 years of experience in banking and financial services and is wildly considered a leading authority in the clearing market infrastructure.

Chan has over 20 years of experience in banking and financial services and is wildly considered a leading authority in the clearing market infrastructure.

Dr. Paolo Coppola/Co-Founder

Coppola is an entrepreneur, physician, and engineer who cofounded STAT-Health Urgent Care Systems. He has various degrees in Mathematics and Engineering.

Coppola is an entrepreneur, physician, and engineer who cofounded STAT-Health Urgent Care Systems. He has various degrees in Mathematics and Engineering.

Todd Aydelotte/Co-Founder

Aydelotte is one of the nation's leading technology marketers with over 25 years of experience, he has managed global campaigns for Intel, AMD, and Century Link.

Conclusion

My initial thoughts on this project are very positive. I see implementation being rather difficult for non-crypto-centric people but the project is in the very early stages of development. If they can streamline the user creation in a way where the user doesn't realize they are using blockchain, I believe adoption would be more prevalent. Usability would be limited to those who understand crypto terminology and security procedures for keeping data secure.

The clearinghouse layer excites me to no end, I have always been an advocate that any system designed to solve a problem should have an underlying element to prop the solution up. That way it's easier for the solution (Data Sovereignty) to not be limited by funding needs, which the clearinghouse would provide through Business to Business (B2B) transaction settlements.

Having the social tether dislocated from the B2B aspect allows for both functions to remain separate yet symbiotic. Developers can focus on maintaining and advancing the RVP mission without having a need to turn a dollar. Eventually, both functions would be autonomous and RVP holders would greatly see price appreciation over the long run.

I would like to make a special connection that I have found through digging. The team is very stacked, and very connected. It appears that JP Morgan is looking for a Crypto Clearinghouse, Source, and it just so happens that the clearinghouse advisor for RVP (Gary Chan) is a managing director at JP Morgan. It's not entirely farfetched to see the ties and connections there in place and how they could result in partnerships down the road. With RVP on the frontline, is this a particularly bullish sentiment for RVP Token in the coming months?

If you liked this article, please show me support on my Twitter page Here, and like, retweet to let your peeps know, and follow me for more ChillDaddy Deep Dives.

If you want to support me, Buy me a coffee, thanks, and know what you hold!